Qatar’s construction equipment market, valued at 4,039 units in 2024, is projected to expand to 5,032 units by 2030, growing at a CAGR of 3.73%.

Market Leaders & Competitors

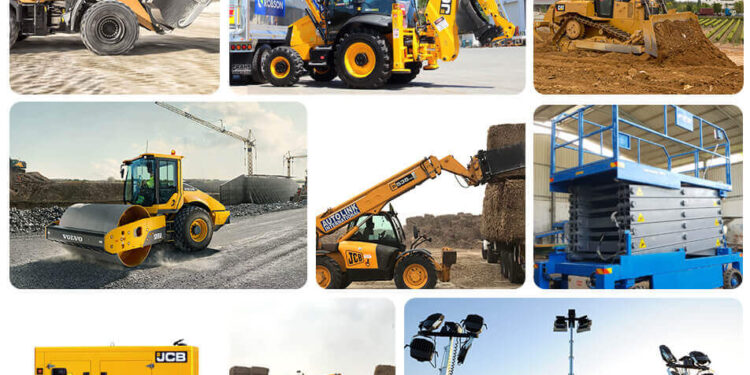

Front-runners: Caterpillar, Komatsu, Liebherr, Volvo CE, Hitachi Construction Machinery, and HD Hyundai dominate the market with strong share and diverse product portfolios.

Niche players: Tadano, Terex, SDLG, Manitou, Merlo Spa, Yanmar, Bobcat, Takeuchi, and Bomag maintain a steady presence but with limited diversification.

Emerging challengers: Toyota Material Handling, JCB, Kobelco, XCMG, CASE CE, SANY, LiuGong, Zoomlion, and DEVELON are investing in advanced technologies to compete with market leaders.

Lagging players: Kato Works, AUSA, Ammann, Haulotte, Manitowoc, and JLG continue to have low product diversification and slower tech adoption.

Infrastructure Investments Driving Demand

Qatar is accelerating public infrastructure projects that are expected to significantly boost construction equipment demand:

Doha Metro Project: A two-phase mega development connecting the capital with suburbs and key hubs, including Lusail, Education City, and New Doha International Airport.

Lusail City Development: A 35 sq. km smart urban hub with residential, commercial, retail, healthcare, resort, and entertainment facilities along an 8.5 km shoreline.

$19 Billion Project Rollout (2024–2025):

Ashghal to launch ~116 tenders worth $16.2B.

Kahramaa to roll out 279 tenders worth $2.4B across electricity, water, and service sectors.

Residential Expansion: 21 new housing projects in 2024, with over 60% concentrated in Lusail and Doha.

Transportation Master Plan 2050: Includes 86 highway schemes, 54 public transport projects, 29 cycling initiatives, and 74 cross-modal integration schemes.

Roads & Infrastructure: Projects like Al Egda Al Heedan and Al Khor (Package 1) involve 19 km of new road networks and 38 km of pedestrian and cycling lanes.

Qatar’s momentum is further reinforced by preparations for the Asian Games 2030 and strong foreign investment following the FIFA World Cup 2022, fueling demand for construction equipment across housing, transportation, and industrial projects.

Source: ResearchAndMarkets